Troubleshooting: Missing Important Tax Forms?

Are you ready to file your regular taxes? Good for you. But what will you do if you don’t have all the required forms for that? If you don’t have an answer to this question, keep on reading, and you will get them.

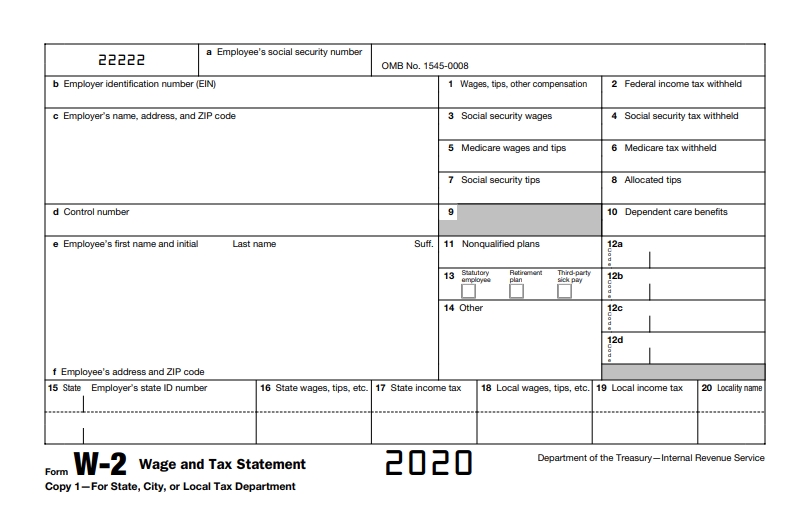

Form W-2

Your employer(s) must send you Form W-2 so that you could use it for filing a federal tax return. In 2020, all employers must provide W-2 filled with 2020 earnings and withhold taxes before January 31, 2021. If you don’t receive your W-2 on time, contact your employer to figure out the reason. For more details on the form, check out our Form W-2 instructions.

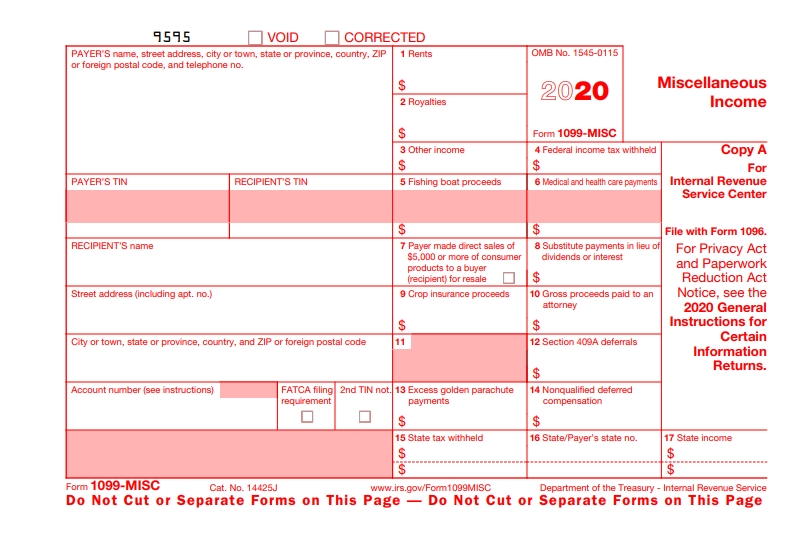

Form 1099

In some cases, you can receive Form 1099 along with W-2 or instead of it. Payers must send it until January 31. You can also get a summary of the interest paid within the bank savings statement or online customer service account. You can file your tax return without waiting for 1099 if you already know the actual info. If you are waiting for a 1099-R form, you must attach it to the return. More information about Form 1099 is available on our website.

Best Time to Contact The IRS

If you don’t receive forms W-2 and 1099-R by mid-February, call the IRS for help. Before making a call, make sure that you know:

- your employer’s name, phone number, address, and ZIP-code;

- employer’s ID (not obligatory);

- your own SSN, ZIP-code, address, phone number, and name.

Misplaced W-2

If you lose your W-2, call your employer to replace it and bee ready to pay a fee for that. If it takes too much time, you must file your tax on time anyway. Use Form 4852 (W-2 Substitute, Wage, and Tax Statement) instead. It will take longer to process your refund, but you won’t be fined for violating the deadlines. Form 4852 instructions are available on our website.

Amended Return Filing

If the IRS sends you back a corrected W-2 or 1099, you must prepare and file an amended return using Form 1040X (Amended U.S. Individual Income Tax Return). Our website provides assistance for Form1040X as well.

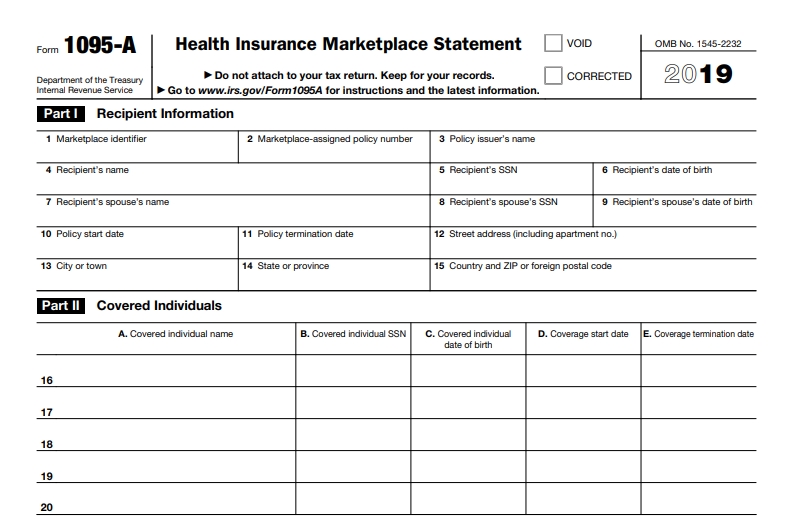

Health Insurance Forms

Filing a tax return, you must wait for the Form 1095-A. Forms 1095-B and 1095-C are also attachable, but not necessary to file along with your tax return. Forms B and C must be sent to you by early March.

Check the Calendar

It’s important to send all the necessary forms on time to avoid problems in the future. If you have any further questions, contact {website name} experts. You can also tell about your experience and add up value to the article in the comments.

Leave a comment

Your comment is awaiting moderation. We save your draft here

0 Comments